Margin call price calculator

Lets say that your business took 400000 in sales revenue last year plus 40000 from an investment. Before trading clients must read.

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

How to calculate profit margin.

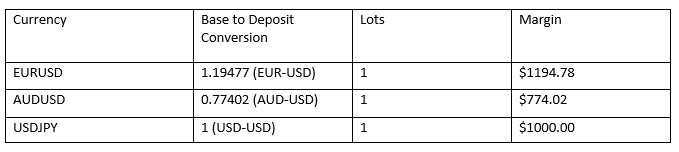

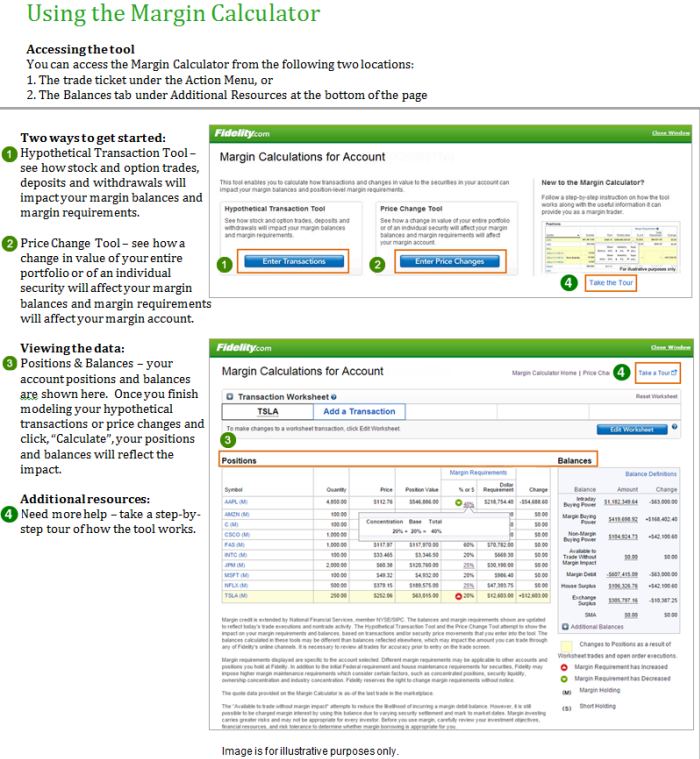

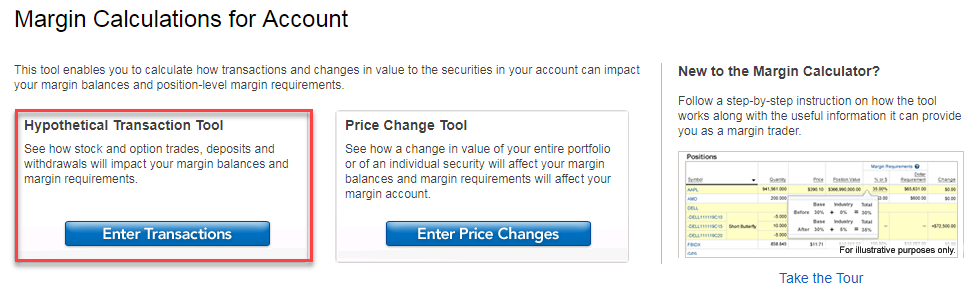

. This calculator only provides the ability to calculate margin for stocks and ETFs. Type the number of units held in the trade. Find Out How Edward Jones Can Assist in Reaching Your Goals.

Find out your revenue how much you sell these goods for for example 50. Use the Calculate button. Alternatively call 312-542-6901 to receive a copy of the ODD.

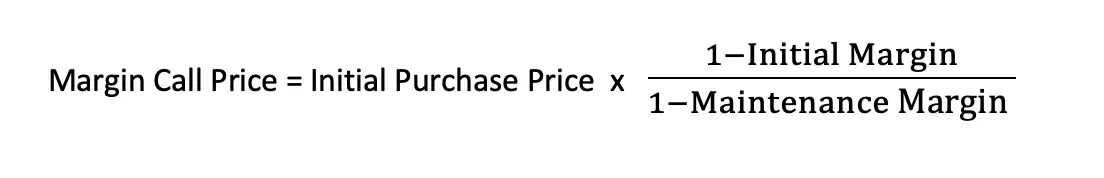

Assuming a 50 initial margin and 25 maintenance margin we can enter our numbers into the margin call price formula. To do this follow the below instruction after completing the previous. How to Cover a Margin Call.

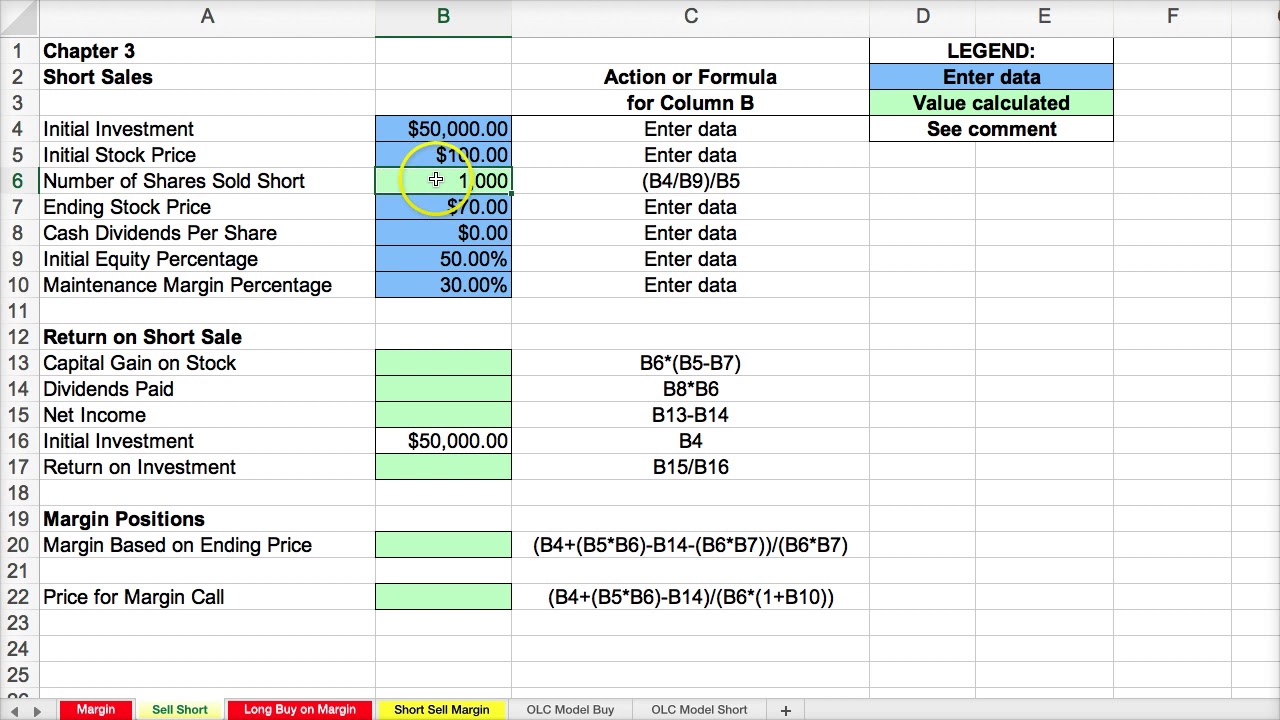

M a r g i n. In this step we will see how we can get the final selling price using the formula that we inserted in STEP 1. If the price moved from the current price to this calculated price there would be a margin.

Choose the action the type of trade buy or sell. The price at which you will receive a margin call on a long position in a stock is given by. You had total expenses of 300000.

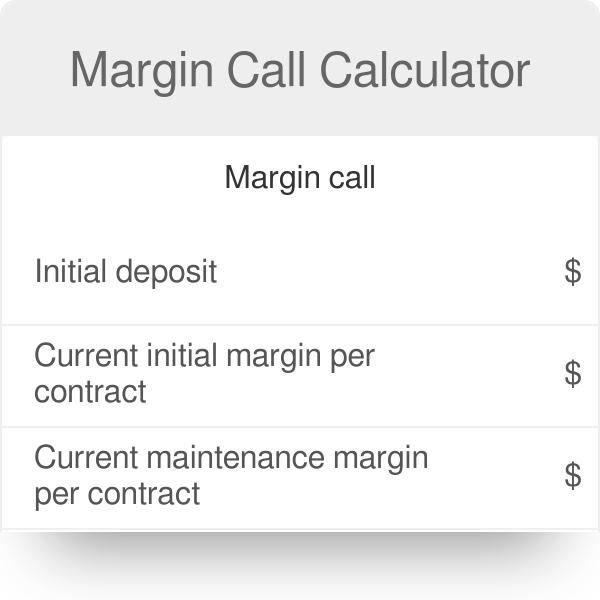

Ad Edward Jones Offers Financial Guidance Tailored to Your Goals. P R - C. A margin call is a concept associated with trading on a margin ie.

Level I Equity. What is the margin call price. Suppose an investors buys a stock for 20 per share with an initial margin of 50 and a maintenance margin of 25.

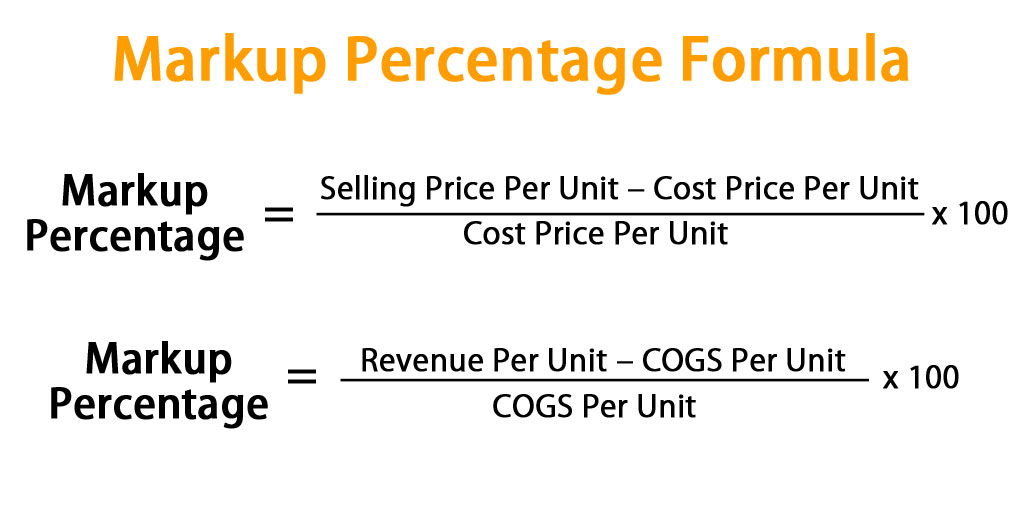

Can anyone tell me how i calculate the price at which a margin call would occur. Example of net profit margin calculation. The gross profit P is the difference between the cost to make a product C and the selling price or revenue R.

Type your account balance. Instructions to use calculator Enter the scientific value in exponent format for example if you have value as 00000012 you can enter this as 12e-6 Please use the mathematical. This tool will calculate the selling price and profit made for an item from the purchase price or cost at the required level of percentage.

It can also be calculated as net income divided. Definition Calculation Price Formula Example. The mark up percentage M is the profit P.

Say that you have a 10000 balance. Find out your COGS cost of goods sold. Select your margin ratio.

Let us consider a margin call example. For example if the investor in the example above did not. The margin call calculator exactly as you see it above is 100 free for you to use.

The advantage of trading on margin is that you can make a high percentage of gains compared. If a margin call is not satisfied the broker can liquidate the investors position. Posted by Bill Campbell III CFA on June 12 2013.

The margin call is the difference between the current equity balance in your account and how much equity you need to maintain. To understand what the margin. Margin Call Price 120000 1 50 1 25 Margin Call.

Profit margin is the amount by which revenue from sales exceeds costs in a business usually expressed as a percentage. It is simple to calculate a margin call or the amount that would cause stockbrokers to warn traders to maintain a minimum level for account maintenance. Cost from selling price and profit margin.

Margin Call Price Formula Example Accountinguide

Margin Call Price Formula And Calculator Excel Template

What Is A Margin Call Margin Call Formula Example

Maintenance Margin Formula And Example Calculation

Margin Calculator Myfxbook

Margin Calculator Step By Step Instruction Fidelity Investments

Avoiding And Managing Margin Calls Fidelity

Excel Margin And Short Sell Calculations Youtube

Trading Faqs Margin Fidelity

Margin Calculator Step By Step Instruction Fidelity Investments

Margin Call Calculator

Margin Call Price Formula And Calculator Excel Template

Margin Call On Short Sale Youtube

Markup Percentage Formula Calculator Excel Template

Maintenance Margin Formula And Example Calculation

Margin Call Price Formula And Calculator Excel Template

Margin Call Price Formula And Calculator Excel Template

Komentar

Posting Komentar